Changes to the WRS Capital Preservation Fund

The Wyoming Retirement System 457 Plan (“Plan”), with the assistance of a third-party investment advisor, regularly monitors the investment options in the Plan. WRS made the decision to transition the portfolio management of the WRS Capital Preservation Fund (formerly named Stable Value Fund) to take advantage of better investment and plan administration pricing which benefits Plan participants. With this transition, the WRS Capital Preservation Fund will also have a lower gross expense ratio (0.33% compared to 0.39% now). 1 The objective and risk/return profile of the WRS Capital Preservation Fund will not change – it is designed to be a conservative investment option that seeks to provide safety of principal and a stable credited rate of return with minimal volatility.

This transition to Great West Financial, an affiliate of Empower Retirement, as the portfolio manager will take place in June 2018; however, you don’t need to do anything.

If you have a balance in the WRS Capital Preservation Fund, your second quarter statement will show a transfer transaction detailing the movement of money from the current portfolio manager to the new portfolio manager.

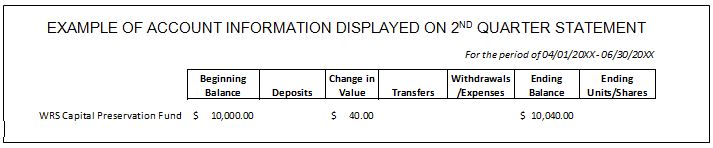

You will also see a change in how interest earnings are reported. If you currently have money invested in the WRS Capital Preservation Fund, you will no longer see units associated with your fund value. Instead, your fund growth will be reflected as interest credited in the Change in Value column. See below for an example of how the interest credited will be shown.

If you would like to redirect your future contributions and/or your existing balance in the WRS Capital Preservation Fund to another investment option, visit www.wrsdcp.com or call the voice response system at (800) 701-8255. 2 You can reach WRS at (307) 777-3325 if you have questions.

Carefully consider the investment objectives, risks, fees and expenses of the annuity and/or the investment options. Contact us for a prospectus, a summary prospectus and disclosure document, as available, containing this information. Read them carefully before investing.

1 Gross expense ratios are the funds’ total annual operating costs expressed as a percentage of the funds’ average net assets over a given time period. They are gross of any fee waivers or expense reimbursements and are subject to change. 2 Transfer requests made via the website and/or the voice response system received on business days prior to close of the New York Stock Exchange (4:00 p.m. Eastern Time or earlier on some holidays or other special circumstances) will be initiated at the close of business the same day the request was received. The actual effective date of your transaction may vary depending on the investment option selected.