Pension Eligible/Ineligible Compensation

Retirement Contributions for Traditional Pay

The Wyoming Retirement System (WRS) has defined what constitutes pension eligible compensation. WRS will review contributions and employee compensation to ensure compliance with applicable law and regulation.

WRS cannot accept retirement contributions on nonrecurring payments to employees. Nonrecurring amounts are considered equivalent to bonuses paid in addition to base salary and have the potential to “spike” retirement benefits without providing the consistent funding necessary to pay future benefits.

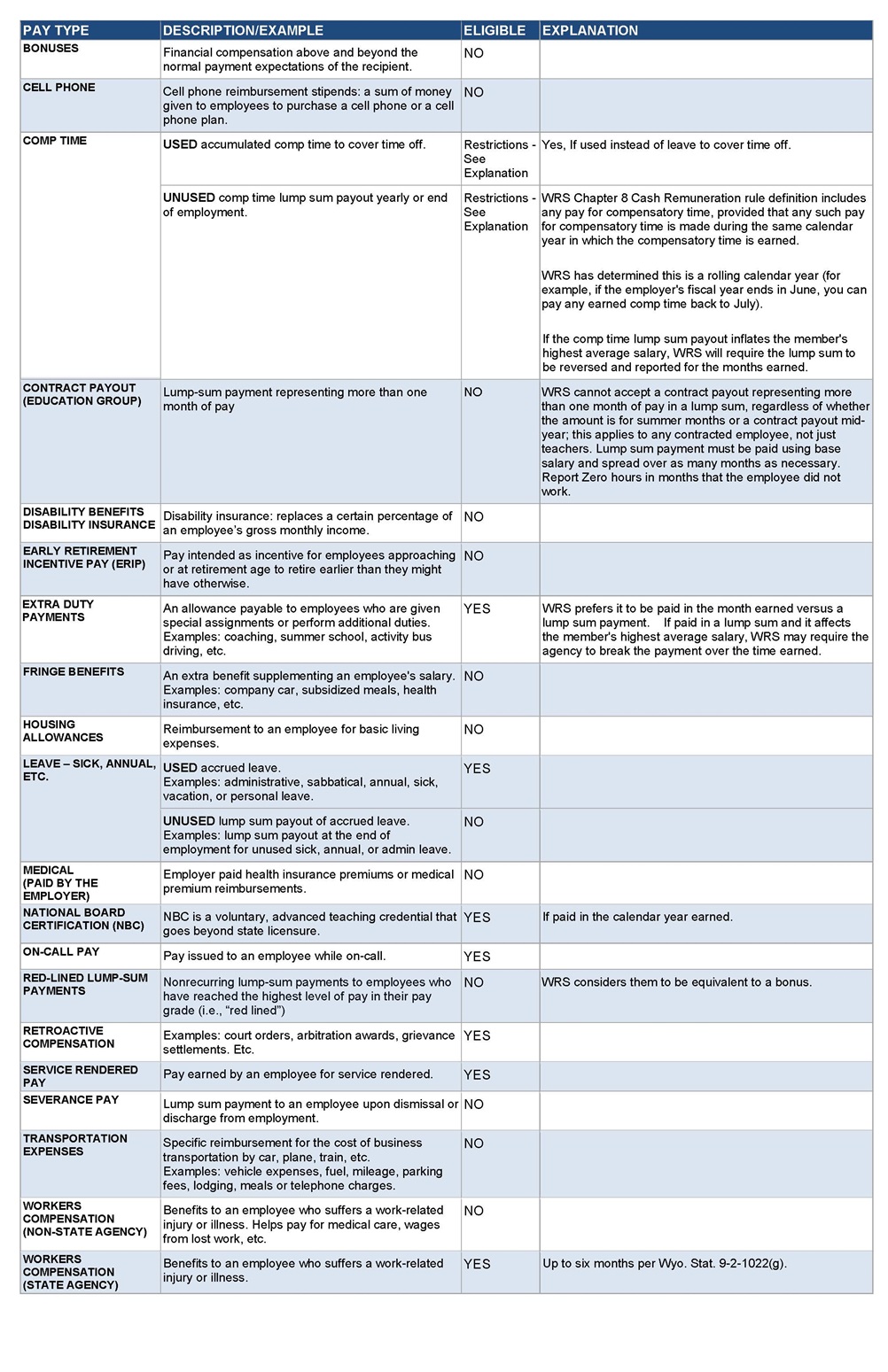

Below is a chart describing the most common pay types employers encounter and whether the pay is pension eligible.

Additional Payment Types Information

- Any payment made during three years of employment deemed to increase the highest average salary for the primary purpose of increasing a retirement benefit is not pension eligible.

- Nonrecurring lump-sum payments to employees who have reached the highest level of pay in their pay grade (i.e., “red lined”) are not pension eligible.

- Call for specific pay types not listed on this webpage for WRS staff to review and provide guidance regarding eligible compensation.

Wyoming State Statute Employer Definition

Contact WRS Employer Relations

For information about monthly pension contributions and reporting, your organization joining WRS, employer agreements, or other employer questions call

(307) 777-2077