Help for Mix-Your-Own Investors

Deciding Which Investments are Right for You

WRS provides a selection of investments which will allow you to put your money into a wide variety of investment choices. The choices offered meet the high-quality, low cost requirements of WRS. You can also choose to invest in a wide variety of mutual funds through a self-directed brokerage account.

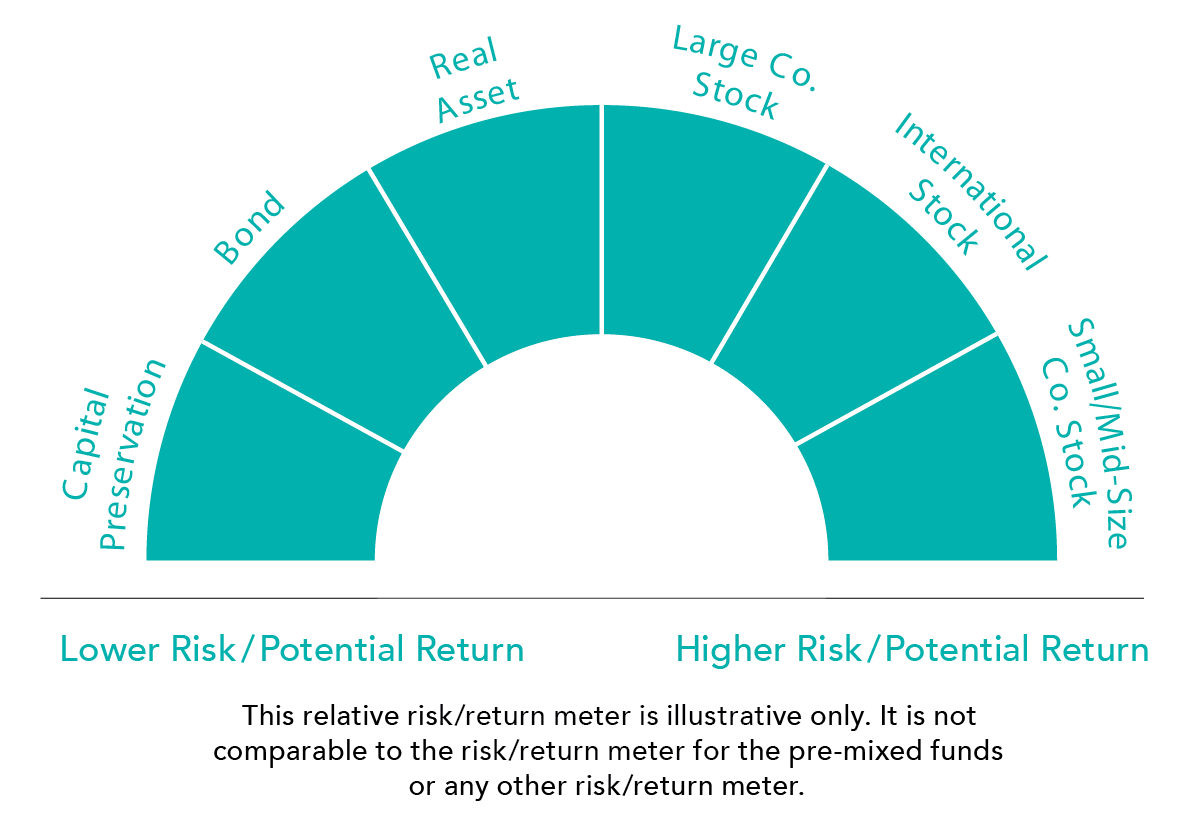

The Plan offers you choices that allow you to mix your own investments. You’ll find them in the group “mix-your-own-funds.” A “do-it-yourself” investor will most likely decide to spread their account contributions across different types of investments: small and mid-size companies, international companies, large companies, real assets, bonds and capital preservation funds.

If you don’t have the time, interest or knowledge to mix your own investments, WRS offers choices for the “do-it-for-me” investor. In this case you make one choice among the group called “pre- mixed funds.” These choices are designed to invest a percentage of a participant’s contributions automatically in all areas of the market balancing comfort with risk and how many years that you have until reaching a retirement age of 65.

Invest for the Long Term

Whether you mix your funds or use a pre-mixed fund, it’s a good idea to keep your long-term investment goals in mind. Investments in stock, bond and real asset funds frequently rise and fall in value. This is called volatility. When you put your money in an investment option you are actually buying shares in that fund. A rise or fall in your account value occurs because the price of shares in the fund has gone up or down.

Growth occurs when the value of your shares is more than the price you paid for your shares. When share prices fall, you still own the shares and as long as you don’t sell your shares, there is the probability the share price will rise again, raising the value of your account. It’s important to consistently contribute and invest in your fund selection when share prices fall; because the share price is lower, you will buy more shares than you may have prior to prices falling, kind of like buying something on sale. If and when share prices rise, the result will be more value in your account. Sometimes it can take years for fallen share prices to rise.

If you are in your 20s, 30s or 40s, you may have many years of investing ahead of you, and will have time to wait for the prices to rise. Even if you are in your late 50s or early 60s, it’s likely you may be invested for another 10 or even 20 years, which may be plenty of time to ride out any drops in share prices. Keep your long-term goals in mind when the prices in the stock and bond markets experience volatility.

Understand Your Investment Choices

The investments offered by WRS are referred to as “funds,” or “mutual funds.” But what is a mutual fund? A mutual fund is simply a collection or a basket of individual company stocks, bonds or other securities pooled together and managed by a professional manager or investment company. Mutual funds offset the risk of investing in just one company. When your investments are in mutual funds your risk is spread over all the companies in the mutual fund.

The WRS 457 Plan Investment Menu is made up of custom fund-of-funds developed by WRS to help participants achieve their retirement goals. Each was carefully constructed to consider expected returns, risk, and fees with minimal overlap of specific investments.

WRS 457 Plan Fund Information

Help for Mix-Your-Own Investors

The WRS Help for Mix-Your-Own Investors brochure provides further information about the investment choices in the 457 Plan, as well as tools to help you make informed decisions.

457 Plan Online Account

457 Plan Investing Resources

Available Retirement Seminars

Get information on the types of seminars offered by WRS Educators.