Retirees

Committed to Supporting Wyoming’s Retirees

WRS is committed to supporting Wyoming’s retirees by providing secure, reliable income that honors a lifetime of public service and strengthens our state’s communities.

We pay nearly $800 million in pension benefits a year, serving more than 82,000 active members and beneficiaries.

Your first retirement payment

Your first payment will be on the retiree payroll date for the month after WRS receives your final contribution from your employer. Talk with your employer to find out when they will submit your final contributions and termination notice. If you work for a school district, find out if they are paying summer contributions in advance or paying throughout the summer. Your first payment will be retroactive back to your retirement date.

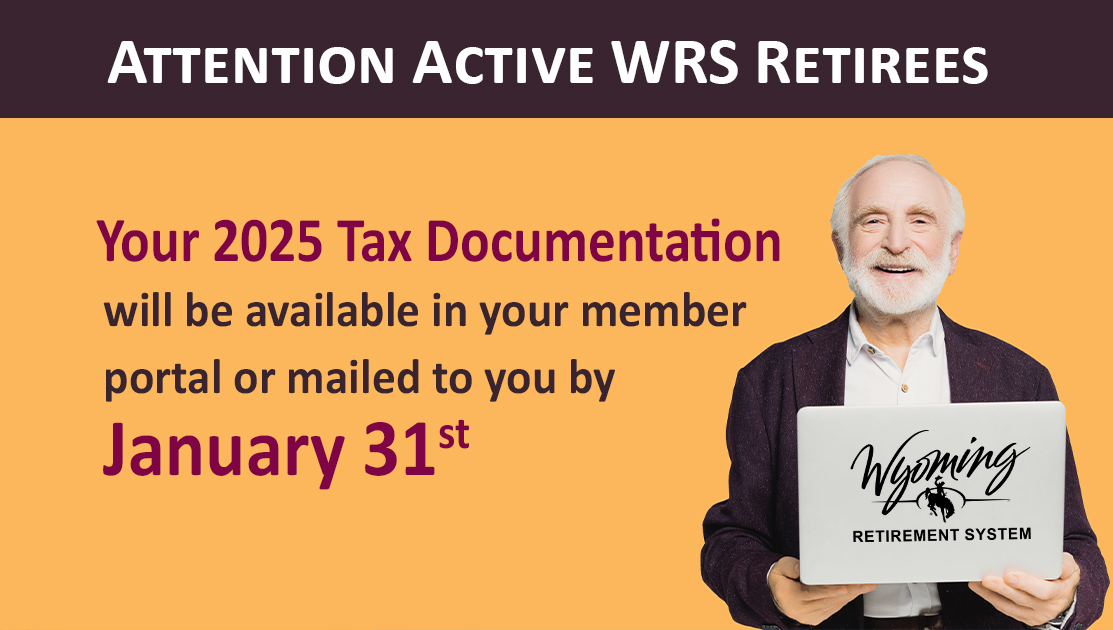

Taxes / 1099-R

Your monthly benefit is reported to the IRS as income, and you are responsible for paying any taxes. You will receive a Form 1099-R annually for tax reporting purposes.

Retirement news& updates

interested in learning more about the wyoming state

retirement system? news and updates posted weekly.