Employer Contribution Notice

July 1, 2024, will bring changes to contribution rates for the Warden & Patrol Plan, Judicial Plan, and Law Enforcement Plan. This document outlines those changes and the transitional payroll process.

Paid Fire Plan B, effective 7/1/2024

A “rehired retiree rule” was added to the Fire B pension plan. This allows a retiree to keep drawing their retirement benefit if they return to work under certain conditions. Rehiring a retired member under this article shall be in accordance with the Wyoming Retirement Act, W.S. 9-3-415(g) through (j).

Warden, Patrol & DCI, effective 7/1/2024

Employers may fund some or all of the required employee contributions. For Warden, Patrol & DCI employees, the rate change is shown in the chart below.

| Warden & Patrol | Employee Paid by Employer |

Employee Paid by Employee |

Total Employee |

Total Employer |

Total Contribution |

| 7/1/2017 to 6/30/2024 | 11.92% | 2.64% | 14.56% | 14.88% | 29.44% |

| 7/1/2024 to future | 15.89% | 3.03% | 18.92% | 14.88% | 33.80% |

Judicial Plan, effective 7/1/2024

Employers may fund some or all of the required employee contributions. For judicial employees the rate change is shown in the chart below.

| Judicial | Employee Paid by Employer |

Employee Paid by Employee |

Total Employee |

Total Employer |

Total Contribution |

| 7/1/2008 to 6/30/2024 | 5.57% | 3.65% | 9.22% | 14.50% | 23.72% |

| 7/1/2024 to future | 7.47% | 4.00% | 11.47% | 14.50% | 25.97% |

Law Enforcement, effective 7/1/2024 (three-year program)

Employers may fund some or all of the required employee contributions. For law enforcement employees the rate change is shown in the chart below.

| Law Enforcement | Employee Paid by Employer* |

Employee Paid by Employee* |

Total Employee |

Total Employer |

Total Contribution |

| 7/1/2002 to present | 8.60% | 8.60% | 8.60% | 17.20% | |

| 7/1/2024 to 6/30/2025 | 8.60% | 0.90% | 9.50% | 9.50% | 19.00% |

| 7/1/2025 to 6/30/2026 | 8.60% | 1.80% | 10.40% | 10.40% | 20.80% |

| 7/1/2026 to future | 8.60% | 2.70% | 11.30% | 11.30% | 22.60% |

*8.60% “pickup” of employee contribution is for the State of Wyoming only. Local employers make their own decisions

Contribution Rate Changes/Transitional File Uploads

Continue to the instructions below ONLY if your July payroll file contains any June contributions that you want to pay at the lower contribution rate. If your pay periods are calendar month periods, or if you choose to report at the higher rate instead of splitting it out, then this section does not apply to you.

When a plan’s contribution rate changes, some employers report payroll spanning two months, for example, from June 16 to July 15. To support paying contributions at both the old rate and the new rate, use column (C) "Payroll End Date," indicating the last day of the month. This column is solely for contribution rate transitional file uploads when contributions need splitting between two rates. Column C instructs the system which rate to apply: if contributions pertain to the prior period, they will be charged at the old rate, otherwise at the new rate. This consideration is particularly crucial for employers paying employees two weeks behind, as their monthly contribution file always contains pay split between two months.

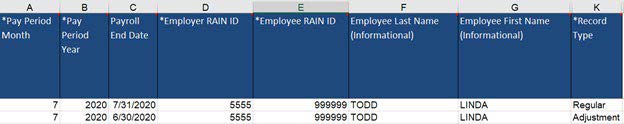

EXAMPLE 1:

Row 1 displays an employee with hours worked in July reported on the July payroll. The new contribution rate applies based on the “Payroll End Date” of 7/31/2024 in column (C); choose “Regular” from the drop-down in column (K). Row 2 illustrates the same employee with hours worked in June reported on the July payroll. The old contribution rate applies based on the “Payroll End Date” of 6/30/2024 in column (C); choose “Adjustment” from the drop down in column (K).

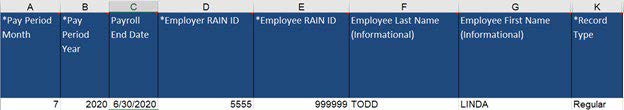

EXAMPLE 2:

Displays an employee with hours worked in June reported on the July Payroll with no hours to report for the July payroll (due to payroll cut off dates). The old contribution rate applies based on the “Payroll End Date” of 6/30/2024 in column (C); choose “Regular” from the drop-down in column (K).

If you have any questions on the above process contact the Employer Relations Department at 307-777-2077 or ret-employer-relations@wyo.gov.